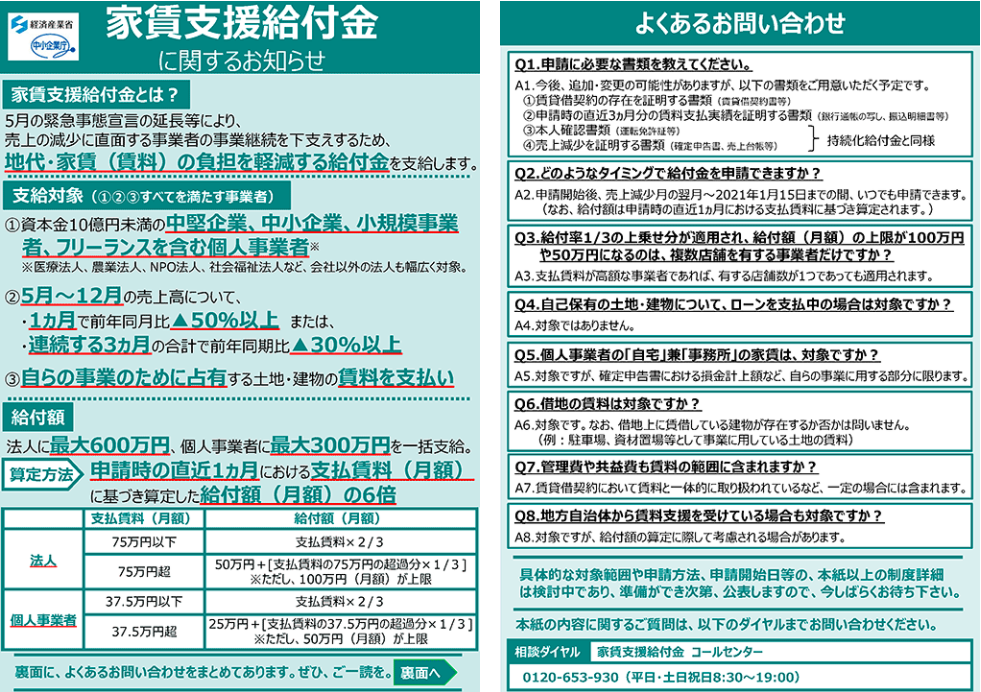

On July 3rd, Ministry of Economy, Trade and Industry has announced to provide up to 6 million yen of “Rent support allowance” to companies and individuals whose sales has dropped due to the extension of the emergency declaration in May and the impact of coronavirus pandemic.

Who can apply:

- Sole proprietors, including medium-sized companies, small and medium-sized enterprises, small businesses, and freelancers with a capital of less than 1 billion yen.

* Widely applicable to corporations other than companies such as medical corporations, agricultural corporations, NPO corporations, and social welfare corporations. - About sales from May to December:

- 50% decrease from the same month of the previous year or

- 30% decrease from the same period of the previous year for the total of 3 consecutive months.

- Pay the rent for the land and building that you occupy for your own business

When to apply:

The application period is from July 14, 2020 to January 15, 2021.

The amount of the allowance:

Up to 6 million yen for corporations and up to 3 million yen for individual businesses

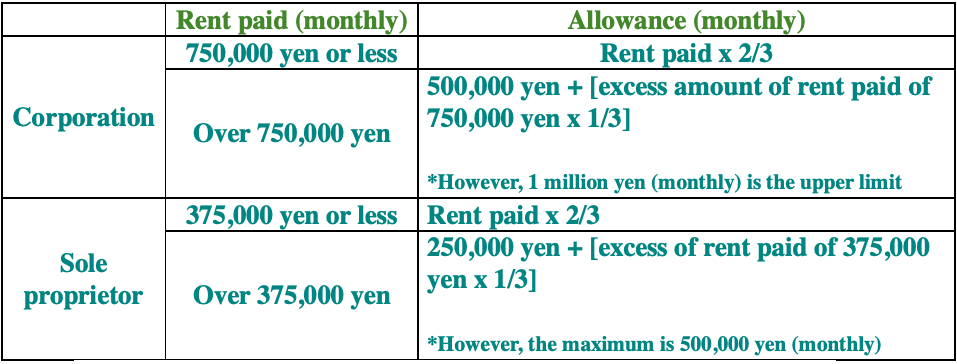

Calculation method:

Six times the amount of allowance(monthly) calculated based on the monthly rent paid at the time of application.

- In the case of a corporation, if the monthly rent paid is less than 750,000 yen, the allowance rate is 2/3, if it exceeds 750,000 yen, it is 500,000 yen, and the excess of 750,000 yen is multiplied by 1/3 of the benefit rate. The combined amount is the monthly allowance amount (up to 1 million yen). The monthly rent is 2.25 million yen, and the maximum allowance amount is 1 million yen.

- In the case of a sole proprietor, if the monthly rent is 375,000 yen or less, the allowance rate will be 2/3, and if it exceeds 375,000 yen, it will be 250,000 yen. The sum of the multiplied amounts is the monthly allowance amount (up to 500,000 yen). The monthly rent is 1235,000 yen and the maximum allowance amount is 500,000 yen.

Documents required for application:

- Documents certifying the existence of a lease contract

- Documents certifying the past three months’ rent payment record at the time of application (copy of bank passbook, transfer statement, etc.)

- Identification documents (driver’s license, etc.)

- Documents certifying decrease in sales (tax return, sales ledger, etc.)

Consultation dial

0120-653-930

weekdays・weekends・holidays :8:30~19:00

Source: https://www.meti.go.jp/covid-19/yachin-kyufu/index.html